student loan debt relief tax credit application 2021

More than 21 million student loan borrowers are entitled to automatic relief thanks to an unprecedented student loan forgiveness plan recent court settlements and rule changes from the US. If you want to get the full amount youre eligible for based on your Estimated Family Contribution make sure you get your taxes taken care of on time.

What Does Student Debt Cancellation Mean For Federal Finances Committee For A Responsible Federal Budget

Tax-free Student Loan Forgiveness.

. And all of the programs are temporary. CALL STUDENT LOAN RELIEF HELPLINE. That was for borrowers who attended specific for-profit schools from 2002-to 2014 lived in certain states or were more than seven months late on their loan payments before July 31 2021.

The Federal Reserve tells us US. College graduates finish school with debt according to a 2021 report from. If youre one of the millions of Americans living with student debt youre likely praying for relief.

Application Tax Regulations And More August 26th 2022. You can follow our guide to learn about the eligibility requirements and application process in 2021 to get forgiveness for your student loans. The American Rescue Plan Act of 2021 included tax-free status for all student loan forgiveness and debt cancellation through December 31 2025.

Heres what you need to know. Average Student Loan Balance. For example they can refinance the debt.

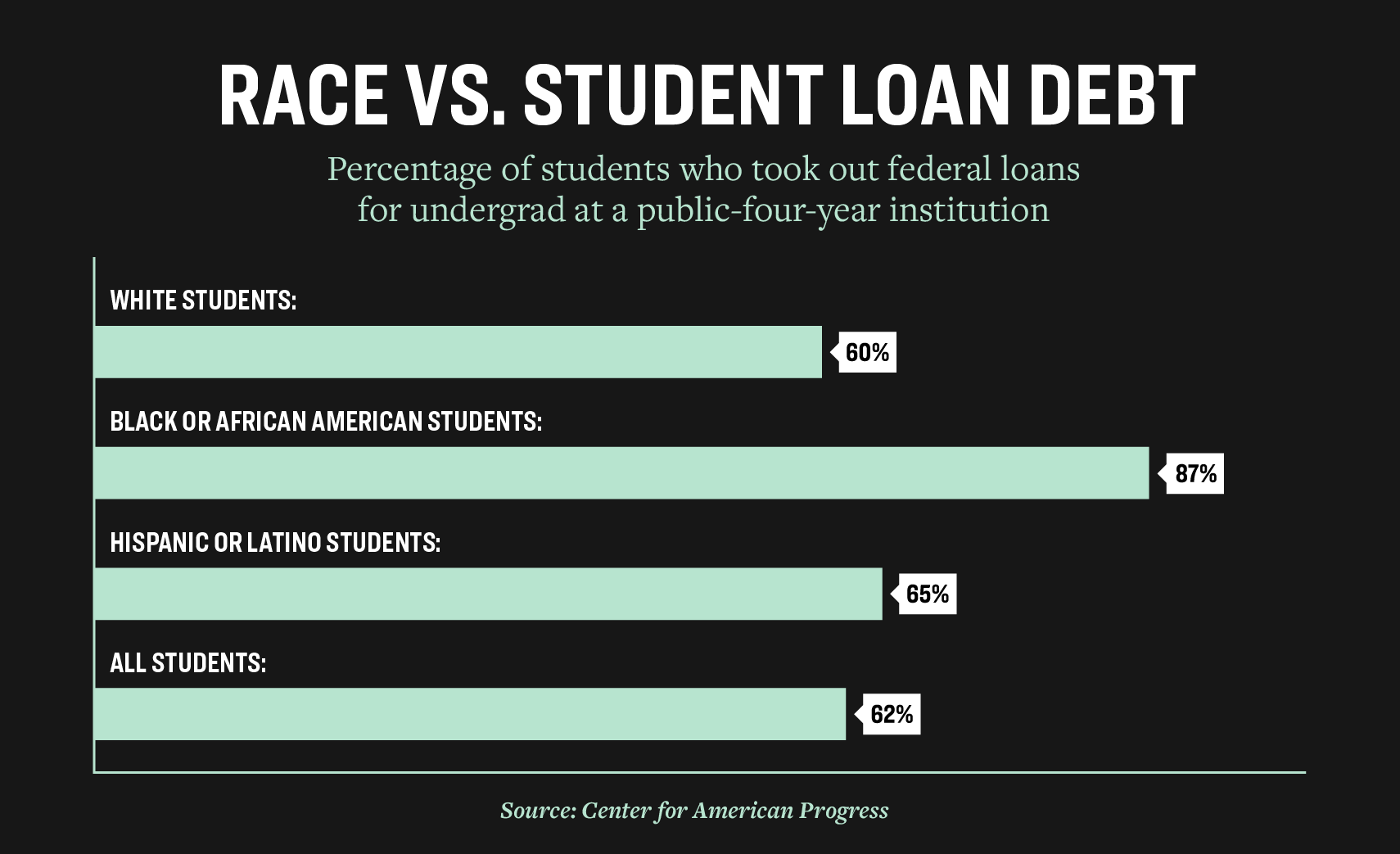

From July 1 2021 through September 15 2021. 24 that covers nearly every federal borrower. 62 of graduates from four-year public and private universities left school with student loan debt approximately 124 million people.

Navient recently offered to cancel 17 billion of private student loan debt. A minimum credit. For example people who are eligible for 20000 in debt relief but have a balance of 15000 will receive 15000 in debt relief.

Thats different from broad student debt cancellation announced Aug. However it would provide much-needed relief for those overwhelmed with student loan debt. Those who need long-term debt relief will have to consider other options.

Parent PLUS and Grad PLUS loan limits. 2 days agoCanceling 10000 in student loan debt is like pouring a bucket of ice water on a forest fire he wrote. Usually the new loan has better terms such as reduced monthly payments.

Here are a few student loan debt statistics that offer a snapshot of the average college debt situation in the United States. Congress also took action concerning the tax treatment of student loan debt forgiveness. Twenty million borrowers are affected by the Biden administrations sweeping student debt forgiveness plan announced in August 2022.

This primarily affects the forgiveness after 20 or 25 years in an income-driven repayment plan. IRS Fresh Start Program. The Government has already sold off the remaining 40 billion of student loan debt it had a concern to many of the over four million uni leavers since 1998 with outstanding loans.

When you borrow from a bank for a credit card loan or mortgage. Applicants must have consistent income have all student loan accounts in good standing be current on rent or mortgage payments and have no bankruptcies on their credit report. When federal Direct Loans are not enough to cover the full cost of attendance graduate students may qualify for a Grad PLUS LoanParents of an undergraduate student may qualify for a Parent PLUS Loan.

President Joe Biden with Vice President Kamala Harris L speaks about the Child Tax Credit relief payments that are part of the American Rescue Plan during an event in the Eisenhower Executive. The Navient settlement agreement includes student loan forgiveness for certain private student loans and modest restitution for some federal student loan borrowers. 25 July 2022 Martin Lewis.

Does the student loan forgiveness plan change anything for income. CALL STUDENT LOAN RELIEF HELPLINE Contact us for FREE consultation. This application and the related instructions are for Maryland residents and Maryland part-year residents who wish to claim the Student Loan Debt Relief Tax Credit.

With the added weight of being a spouse of a military man on active duty the tasks sometimes seem insurmountable. While there may not be one dedicated student loan forgiveness program for military spouses there are options out there to lower your monthly payments and have some balances forgiven. You can still claim tax relief worth up to 280.

If you dont qualify for borrower defense there are alternative ways to manage your student loan debt. The government has programs to relieve crushing tax debtIf youve fallen far behind on income taxes owed to the government the IRS has set up the Fresh Start program a series of rules changes that make it much easier to pay back that debt to the governmentOne part of Fresh Start makes it easier to use a government debt consolidation. Grad PLUS and Parent PLUS Loans differ from Direct Loans in that they are only available to graduate-level students and.

Number of College Graduates With Student Loan Debt. Student loan refinancing involves getting a new loan to pay out other existing debt. Though there are two major sources of student loans federal and private the federal side dominates the action both in amount of money available and loan repayment programs.

That plan cancels up to 10000 in federal loans for borrowers who meet income. In recent weeks as it became clear that. Student Loan Forgiveness Disability.

Student Loan Debt Relief Tax Credit Application for Maryland Residents Maryland Part-year Residents. A student loan is a type of loan designed to help students pay for post-secondary education and the associated fees such as tuition books and supplies and living expensesIt may differ from other types of loans in the fact that the interest rate may be substantially lower and the repayment schedule may be deferred while the student is still in school. Colleges and universities enrolled 175 million students in 2021 a huge number but in fact a slight dip from 2019 that experts connect to COVID-19 challenges.

Well help you reduce your student loan debt or negotiate it. Types of Credit Card Relief for COVID-19. For the 2020-2021 FAFSA the base year is the 2018 tax year.

Student loan borrowers owed 167 trillion as of June 2020 so its a burden many Americans carry. Student loan debt is already daunting. Across the United States 45 million people owe 16 trillion for federal loans taken out for college more than they owe on car loans credit cards or.

Credit card companies and banks are offering coronavirus financial relief ranging from specific payment deferral programs to individual help crafted to the card holders situation. Under the CARES Act which was passed in response to the coronavirus COVID-19 pandemic federal student loan borrowers do not have to make payments for a period of six months. Roughly two-thirds of all US.

New Stimulus Package Makes Student Loan Forgiveness Tax Free Student Loan Hero

Are Student Loans Bad Or Good Debt Here S What You Need To Know Student Loan Hero

20 Companies That Help Employees Pay Off Their Student Loans Student Loan Hero

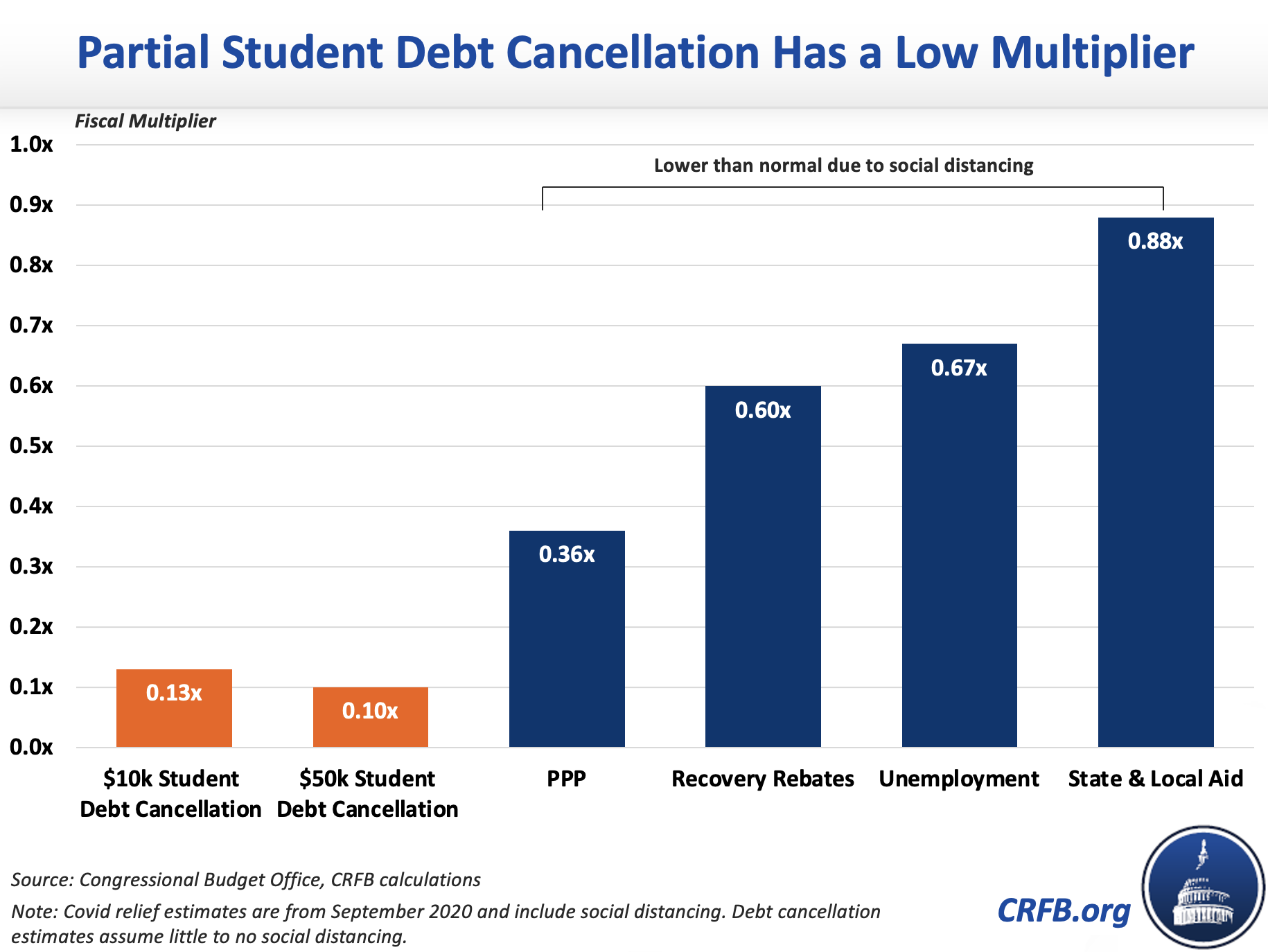

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Get Out Of Your Student Debt Faster Student Debt Student Loans Student Loan Debt Payoff

Student Loan Forgiveness Statistics 2022 Pslf Data

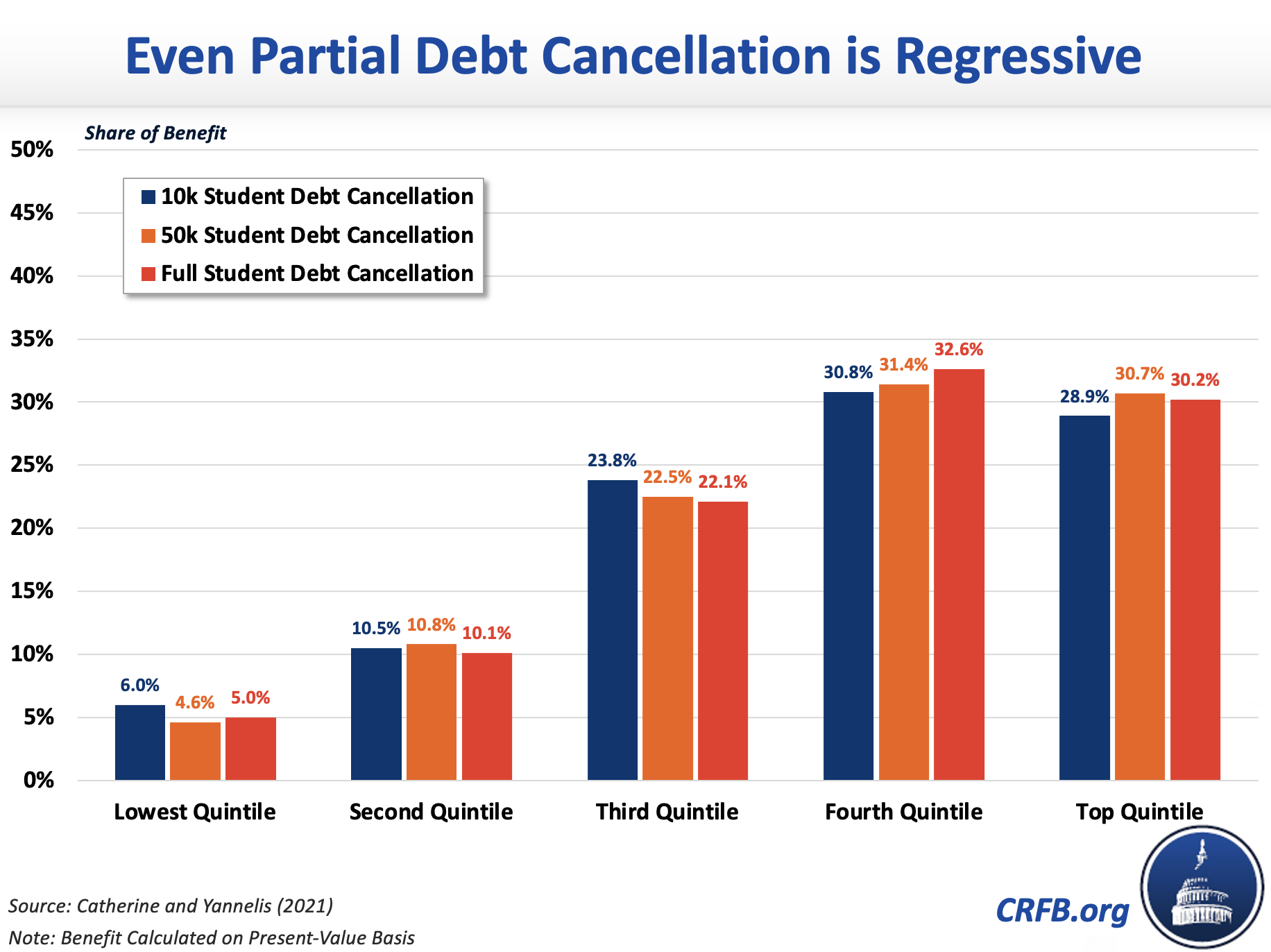

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Putting Student Loan Forgiveness In Perspective How Costly Is It And Who Benefits

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Can I Get A Student Loan Tax Deduction The Turbotax Blog

Partial Student Debt Cancellation Is Poor Economic Stimulus Committee For A Responsible Federal Budget

Student Loan Debt Relief Tax Credit For Tax Year 2022 Maryland Onestop

Who Owes All That Student Debt And Who D Benefit If It Were Forgiven

My Plan To Cancel Student Loan Debt On Day One Of My Presidency Elizabeth Warren

Due Dates For Tds Itr For The Month Of November 2021 Tax Deducted At Source Due Date Make Money From Home

Targeting Student Loan Debt Forgiveness To Public Assistance Beneficiaries Third Way

Prodigy Finance Review International Student Loans International Student Loans Refinance Student Loans Millennial Personal Finance